This coverage is very important since it pays you till retirement a monthly income if you cannot work anymore based on sickness, accident, or psychological illness.

This is important in Germany for foreigners because the public disability insurance has a waiting period of five years, before you are entitled of a disability pension, and has limitations on the amount paid out, and as a self-employed or person who does not pay into the German public pension insurance you have no protection in these cases at all.

The private disability insurance covers you fully from day one of the contract.

To get a coverage for a disability insurance you need to buy it while you are healthy, since later it can be difficult to get through the health examination which insurers request especially if a higher amount for a monthly pension is applied for.

We guide you through the whole process since its is legally also important that all questions are honestly being answered not to lose coverage when the time of need comes. If there are some health risks appear, we also discuss with the insurer if they can be included in as insured with a higher fee or exclude that disease to have coverage for all other cases for you.

What a good occupational disability insurance in Germany should at least contain

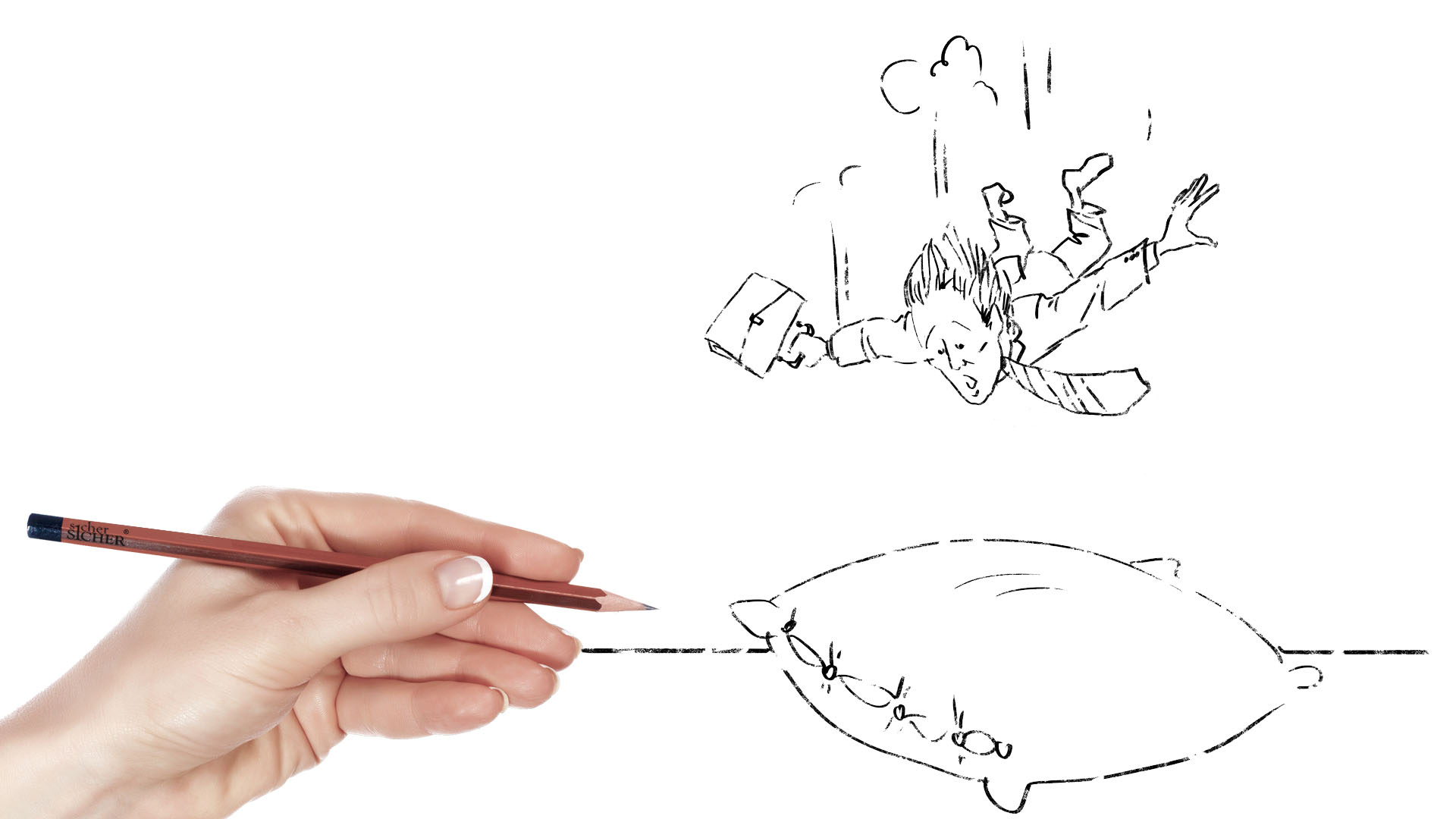

The path to good insurance coverage is often difficult. There are many providers with even more tariffs with a wide variety of services and contract conditions. This makes the selection very difficult.

There are also problems when taking out the insurance: the health conditions, the profession, the risky hobby – all these points are assessed differently by the companies and therefore become further obstacles on the way to insurance cover.

In our opinion, for a contract to offer truly reliable protection, the permanent disabilty insurance in Germany must contain at least the following provisions:

The pension is paid if the insured person is no longer able to work at least 50 percent of the time in the job they last practiced when they were healthy due to illness, physical injury or more than age-appropriate loss of strength. This also applies when changing careers.

Example: If you trained as a locksmith but now works as an IT expert, your work as an IT expert will only be checked. It is not checked whether you could carry out another activity with one’s knowledge and skills or one’s experience and training (so-called “abstract waiver of referral”).

Example: It is not examined whether an operating surgeon could also act as an expert if his hand is permanently impaired after an accident.

Occupational disability occurs if the insured person is expected to be more than 50 percent unable to work for 6 months or if this period has already passed.

The pension is also paid retroactively from the first day of the six-month period. If you report late, your pension will be paid retroactively for at least three years.

If desired, the contribution can be deferred during the performance test. Anyone who is unable to work often finds it difficult to continue paying their monthly insurance premiums. The insurer waives the right to terminate the contract or increase the premiums if it later turns out that the insured person did not declare previous illnesses through no fault of their own.

This can otherwise lead to a nasty surprise if you have paid into insurance for a long time, but when you become incapacitated, it researches it, finds previous illnesses, and ultimately refuses to pay.

The contract applies worldwide.

With temporary recognition, the insurer does not demand the repayment of pensions that have already been granted if it turns out that the claim was not justified.

We work closely in your interest with you, the insurance underwriters to get the best suitable solution for you.

We also advice you to check the liability insurance, since in Germany the law has no limits towards your personal financial capability. In case you also did not have your health insurance sorted for Germany use our experience.

There is always a way and in case you want to know more about the disability insurance in Germany and what is all covered, please fill out the form and send to us, we will prepare the offers for you and discuss the single benefits with you.